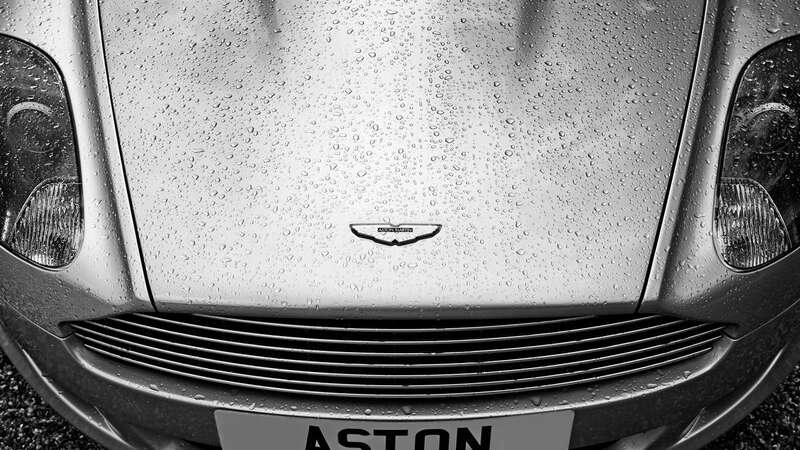

Aston Martin's pre-tax losses have nearly doubled to £138.8million in the first quarter as the luxury car maker slowed down production of several older car models ahead of a series of planned launches later this year.

The FTSE 250 company sold 945 wholesale cars in the three months leading up to March 31, a quarter less than the 1,269 sold during the same period last year. However, the car manufacturer anticipates that new launches will boost its sales later in the year, with its new Vantage and DBX707 models expected to start being delivered before the end of the second quarter.

Meanwhile, deliveries for its flagship V12 and Special models are set to begin in the fourth quarter. Lawrence Stroll, Aston Martin executive chairman, said: "2024 is a year of immense product transformation at Aston Martin, with the introduction of four new models to the market before the end of the year.

"Our first-quarter performance reflects this expected period of transition, as we ceased production and delivery of our outgoing core models ahead of the ramp-up in production of the new Vantage, upgraded DBX707 and our upcoming V12 flagship sports car."

Despite the first-quarter losses exceeding analyst estimates, the company maintains it is still on track to meet its full-year 2024 target. The results and forthcoming launches signify the next phase in a turnaround at Aston Martin in recent years, following Mr Stroll's acquisition of the company in 2020.

Fernando Alonso had Aston Martin staff in stitches in Miami GP radio message

Fernando Alonso had Aston Martin staff in stitches in Miami GP radio message

Net debt, a figure which has been a burden for the car maker since an unsuccessful public listing in 2018, increased to £1.04billion from £868million. However, the company highlighted a £1.2billion refinancing deal, completed after several updates from rating agencies, as an indication that the turnaround plan is progressing well.

Read more similar news:

Comments:

comments powered by Disqus